| | | | Notes to the 2016 Grants of Plan-Based Awards Table Michel Vounatsos

Chief Executive Officer (1) | | | |  | | | | Susan H. Alexander Executive Vice President, Chief Legal Officer and Secretary | | | | | | | | | | | | | |  | | | | Jeffrey D. Capello Executive Vice President and Chief Financial Officer | | | |  | | | | Paul F. McKenzie, Ph.D. Executive Vice President, Pharmaceutical Operations & Technology | | | | | | | | | | | | | |  | | | | Michael Ehlers, M.D., Ph.D. Executive Vice President, Research and Development | | | | | | Reflects the potential future payouts of awards granted in 2016 under our annual bonus plan and our LTI program for each NEO as of the grant date. For NEOs hired during 2016 (Mr. Vounatsos and Dr. Ehlers), our annual bonus plan is prorated based on their hire date. |

(2) | Represents the grant date fair value of CSPUs, MSUs, and RSUs, computed in accordance with ASC 718, excluding the effect of estimated forfeitures. These grants were subsequently adjusted pursuant to the anti-dilution provisions of such awards in connection with thespin-off of Bioverativ on February 1, 2017. The amounts reported in this column do not reflect such anti-dilution adjustments. The grant date fair value for MSU grants is estimated as of the date of grant using a lattice model with a Monte Carlo simulation. Assumptions used in this calculation are included on pageF-44 in footnote 15 of our 2016 Annual Report on Form10-K. The grant date fair value for CSPU and RSU grants was determined by multiplying the number of shares subject to the award (assuming target performance for CSPUs) by the closing price of the Company’s common stock on the grant date. |

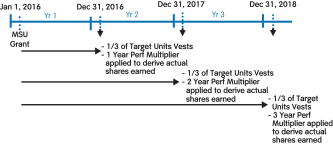

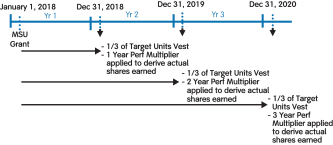

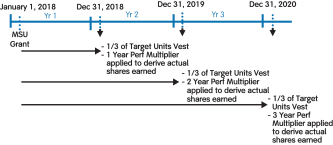

(3) | These amounts relate to the annual grant of MSUs. These are performance-based RSUs tied to the growth in our stock price between the grant date and each of three annual vesting dates. The number of MSUs earned is determined on each vesting date. Columns (f), (g), and (h) represent the number of MSUs that can be earned based on performance at the threshold level of 50%, target level of 100%, and the maximum level of 200%, respectively. To the extent earned, the award becomes eligible to vest ratably over three years, as described in further detail under the heading “Long-Term Incentives (LTI)” above. |

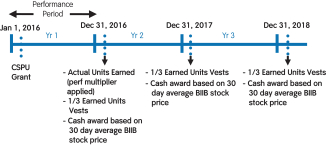

(4) | These amounts relate to the annual grant of CSPUs. These are performance-based RSUs tied to our 2016 financial performance and subsequently subject to time-based vesting. The number of CSPUs earned is determined in early 2017 based on 2016 revenue and adjusted free cash flow performance against target. Earned CSPUs will vest ratably over three years. These awards are settled in cash or stock at the discretion of our Compensation Committee upon the vesting date based on the30-day average closing price of our common stock. Columns (f), (g), and (h) represent the number of CSPUs earned if the Company performance multiplier were 50%, 100%, and 200%, respectively. |

(5) | These amounts relate to our 2016 annual bonus plan. The amounts shown in column (d) represent the 2016 target payout amount based on the target percentage applied to each NEO’s base salary as of December 31, 2016. For 2016, the bonus targets were 140% of salary for Dr. Scangos and 70% of salary for all other NEOs. In 2016, because the individual performance multiplier was the same as the Company performance multiplier under our 2016 annual bonus plan, the amounts in column (c), (d), and (e) represent a payment if the Company performance multiplier and the individual performance multiplier were each 50%, 100%, and 150%, respectively, which amounts are prorated for Mr. Vounatsos and Dr. Ehlers based on their hire dates. Actual amounts paid to each NEO under this plan are included in the“Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. |

(6) | These amounts relate to special grants of time-based RSUs, as described in further detail in the CD&A above under the heading “2016 and 2017 Hiring- and Transition-Related Compensation Decisions.” |

| | | | | 47 | |  | |  |

| | | 5 | | Executive Compensation Matters (continued) |

| Outstanding Equity Awards at 2016 FiscalYear-End Executive Summary

|

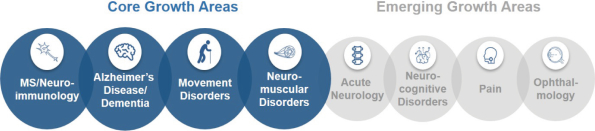

2018 Highlights We had a productive and successful 2018. We generated record revenues of $13.5 billion for the year, demonstrated resilience in our MS business, continued a strong global launch for SPINRAZA, the first approved treatment for SMA, and made significant progress in our biosimilars business. We added six clinical programs across our strategic core and emerging growth areas and had a strong year for business development. We provided value to our stockholders through the return of approximately $4.4 billion in capital through share repurchases and we continued our leading efforts in environmental, sustainability and diversity matters. Our executive compensation programs for 2018 were aligned with stockholder interests as compensation earned under these programs was closely-linked to the achievement of our corporate performance goals. We achieved or exceeded the vast majority of the corporate performance goals that we set at the beginning of the year under our incentive compensation plans and, accordingly, the payouts under these plans for 2018 were above target payout levels. | | | | | | 31 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

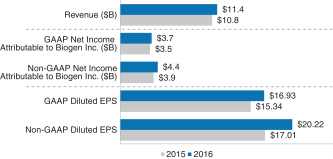

A brief summary of our 2018 business, financial and executive compensation highlights are as follows: Financial Performance The following chart provides a summary of our financial performance for 2018 compared to 2017:

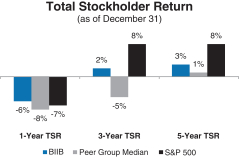

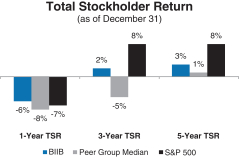

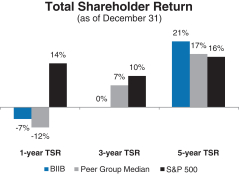

A reconciliation of our GAAP toNon-GAAP financial measures is provided in Appendix A to this Proxy Statement. Total Stockholder Return Ourone-, three- and five-year total stockholder return (TSR)* compared to our peer group and the Standard & Poor’s 500 (S&P 500) is set forth below.

| * | TSR is a measure of performance over time that combines changes in share price and dividends paid to show the total return to the stockholder expressed as an annualized percentage. |

Product and Pipeline Developments The following provides a summary of our product and pipeline developments for 2018: Product Developments In March 2018 we and AbbVie Inc. announced the voluntary worldwide withdrawal of ZINBRYTA for relapsing MS (RMS). In October 2018 we and Samsung Bioepis launched IMRALDI, an adalimumab biosimilar referencing HUMIRA, in Europe. Applications for Marketing and Agency Actions In October 2018 the FDA granted BIIB092, ananti-tau mAb, fast track designation for progressive supranuclear palsy (PSP). In December 2018 Alkermes submitted a NDA to the FDA for the review of BIIB098 (diroximel fumarate). Alkermes is seeking approval of diroximel fumarate under the 505(b)(2) regulatory pathway. If approved, we intend to market diroximel fumarate under the brand name VUMERITY. This name has been conditionally accepted by the FDA and will be confirmed upon approval. | | | | | | 32 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

Clinical Trials MS and Neuroimmunology In September 2018 we completed enrollment of the Phase 2b AFFINITY study evaluating opicinumab, anti-LINGO, as anadd-on therapy in MS patients who are adequately controlled on their anti-inflammatory disease-modifying therapy (DMT), versus the DMT alone. In November 2018 we initiated the Phase 3b NOVA study evaluating the efficacy and safety of extended interval dosing (every six weeks) for natalizumab compared to standard interval dosing in patients with RMS and enrolled the first patient in December 2018. In December 2018 we dosed the first patient in a bioequivalence study to test whether exposure levels of PLEGRIDY are maintained with intramuscular administration. Neuromuscular Disorders | • | | In September 2018 we enrolled the first patient in the Phase 1 study evaluating BIIB078(IONIS-C9Rx), an antisense oligonucleotide (ASO) drug candidate, in adults with C9ORF72-associated ALS. |

| • | | In December 2018 we and our collaboration partner Ionis Pharmaceuticals, Inc. (Ionis) announced results from a positive interim analysis of the ongoing Phase 1 study of BIIB067 (IONIS-SOD1Rx), an investigational treatment for ALS with superoxide dismutase 1 (SOD1) mutations. The following table summarizesinterim analysis showed that, over a three-month period, BIIB067 resulted in a statistically significant lowering of SOD1 protein levels in the equitycerebrospinal fluid and a numerical trend towards slowing of clinical decline as measured by the ALS Functional Rating Scale Revised, both compared to placebo. |

Alzheimer’s Disease and Dementia In May 2018 we initiated a Phase 2 study of BIIB092 for Alzheimer’s disease. In June 2018 we and our collaboration partner Eisai Co., Ltd. (Eisai) announced that elenbecestat, the oral BACE (beta amyloid cleaving enzyme) inhibitor, demonstrated an acceptable safety and tolerability profile in the Phase 2 study, and the results demonstrated a statistically significant difference in amyloid-beta levels in the brain measured byamyloid-PET (positron emission tomography). A numerical slowing of decline in functional clinical scales of a potentially clinically important difference was also observed, although this effect was not statistically significant. In December 2017 we and our collaboration partner Eisai announced that the Phase 2 study of BAN2401, a monoclonal antibody that targets amyloid beta aggregates, an Eisai product candidate for the treatment of Alzheimer’s disease, did not meet the criteria for success based on a Bayesian analysis at 12 months as the primary endpoint in an856-patient Phase 2 clinical study, an endpoint that was designed to enable a potentially more rapid entry into Phase 3 development. In July 2018, based upon the final analysis of the data at 18 months, we and Eisai announced that the topline results from the Phase 2 study demonstrated a statistically significant slowing in clinical decline and reduction of amyloid beta accumulated in the brain. The study achieved statistical significance on key predefined endpoints evaluating efficacy at 18 months on slowing progression in Alzheimer’s Disease Composite Score (ADCOMS) and on reduction of amyloid accumulated in the brain as measured usingamyloid-PET. In July 2018 we completed enrollment of ENGAGE and EMERGE, the Phase 3 studies of aducanumab. In March 2019 we and our collaboration partner Eisai announced that we were discontinuing the EMERGE and ENGAGE Phase 3 studies. Movement Disorders In January 2018 we dosed the first patient in the Phase 2 SPARK study of BIIB054,a-synuclein antibody, in Parkinson’s disease. In September 2018 we completed enrollment of the Phase 2 PASSPORT study of BIIB092 for PSP. Acute Neurology In March 2018 we dosed the first patient in the Phase 2 OPUS study of natalizumab in drug-resistant focal epilepsy. In September 2018 we enrolled the first patient in the Phase 3 CHARM study of BIIB093, glibenclamide IV, in large hemispheric infarction, a severe form of ischemic stroke. | | | | | | 33 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

Neurocognitive Disorders In December 2018 we dosed the first patient in our Phase 2b study of BIIB104 (AMPA) in CIAS. Pain In March 2018 we initiated a Phase 1 study of BIIB095, a Nav 1.7 inhibitor for neuropathic pain. In May 2018 we initiated a Phase 2 study of vixotrigine (BIIB074) in small fiber neuropathy. Other In September 2018 we dosed the first patient in the Phase 2b study of BG00011(STX-100) in idiopathic pulmonary fibrosis, a chronic irreversible and ultimately fatal disease characterized by a progressive decline in lung function. Discontinued Programs In February 2018 we announced that the Phase 2b dose-ranging ACTION study investigating natalizumab in individuals with acute ischemic stroke (AIS) did not meet its primary endpoint. Based on these results, we discontinued development of natalizumab in AIS. The results of the Phase 2b ACTION study do not impact the benefit-risk profile of natalizumab in approved indications, including MS. In October 2018 we announced that we completed the Phase 2b study of vixotrigine (BIIB074) for the treatment of painful lumbosacral radiculopathy (PLSR). The study did not meet its primary or secondary efficacy endpoints and we discontinued development of vixotrigine for the treatment of PLSR. The safety data were consistent with the safety profile reported in previous studies. Business Development In January 2018 we acquired BIIB100 from Karyopharm Therapeutics Inc. BIIB100 is a Phase 1 ready investigational oral compound for the treatment of certain neurological and neurodegenerative diseases, primarily in ALS. BIIB100 is a novel therapeutic candidate that works by inhibiting a protein known as XP01, with the goal of reducing inflammation and neurotoxicity, along with increasing neuroprotective responses. In April 2018 we acquired BIIB104 from Pfizer Inc. BIIB104 is afirst-in-class, Phase 2b ready AMPA receptor potentiator for CIAS, representing our first program in neurocognitive disorders. AMPA receptors mediate fast excitatory synaptic transmission in the central nervous system, a process which can be disrupted in a number of neurological and psychiatric diseases, including schizophrenia. In June 2018 we closed a10-year exclusive agreement with Ionis to develop novel ASO drug candidates for a broad range of neurological diseases (the 2018 Ionis Agreement). We have the option to license therapies arising out of the 2018 Ionis Agreement and will be responsible for the development and potential commercialization of such therapies. In June 2018 we entered into an exclusive option agreement with TMS Co., Ltd. granting us the option to acquireTMS-007, a plasminogen activator with a novel mechanism of action associated with breaking down blood clots, which is in Phase 2 development in Japan, and backup compounds for the treatment of stroke. In June 2018 we exercised our option under our joint venture agreement with Samsung BioLogics to increase our ownership percentage in Samsung Bioepis from approximately 5% to approximately 49.9%. The share purchase transaction was completed in November 2018. In July 2018 we acquired BIIB110 (Phase 1a) andALG-802 (preclinical) from AliveGen Inc. BIIB110 andALG-802 represent novel ways of targeting the myostatin pathway. We initially plan to study BIIB110 in multiple neuromuscular indications, including SMA and ALS. In December 2018 we exercised our option with Ionis and obtained a worldwide, exclusive, royalty-bearing license to develop and commercialize BIIB067, an investigational treatment for ALS with SOD1 mutations. In December 2018 we entered into a collaborative research and license agreement with C4 Therapeutics (C4T) to investigate the use of C4T’s novel protein degradation platform to discover and develop potential new treatments for neurological diseases, such as Alzheimer’s disease and Parkinson’s disease. We will be responsible for the development and potential commercialization of any therapies resulting from this collaboration. | | | | | | 34 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

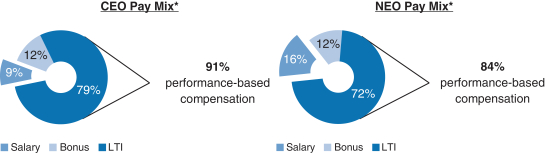

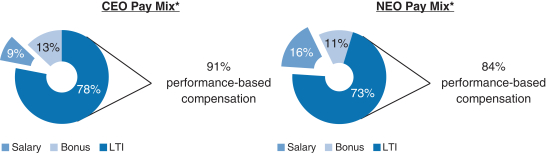

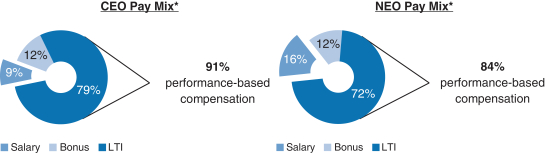

Share Repurchase Activity In August 2018 our Board of Directors authorized a program to repurchase up to $3.5 billion of our common stock (2018 Share Repurchase Program). Our 2018 Share Repurchase Program does not have an expiration date. All share repurchases under our 2018 Share Repurchase Program will be retired. We returned approximately $4.4 billion to stockholders in 2018 through share repurchases under our 2018 Share Repurchase Program and our 2016 Share Repurchase Program, which was a program authorized by our Board of Directors in July 2016 to repurchase up to $5.0 billion of our common stock and which was completed as of June 30, 2018. Other Notable Achievements in the Workplace and Community Awarded the 2018 International Prix Galien as Best Biotechnology Product for SPINRAZA. The prestigious honor marks the seventh Prix Galien for SPINRAZA, following country recognitions in the U.S., Germany, Italy, Belgium-Luxembourg, the Netherlands and the U.K. The International Prix Galien is given every two years by Prix Galien International Committee members in recognition of excellence in scientific innovation to improve human health. Named the Biotechnology Industry Leader on the Dow Jones Sustainability World Index. Recognized as a corporate sustainability leader with Gold Class and Industry Mover Sustainability Awards from RobecoSAM. Continued commitment to operational carbon neutrality highlighted through the use of 100% renewable electricity globally. Committed to reduce carbon emissions by a targeted amount approved by the Science Based Target Initiative, to align ourselves with the global goal of limiting global temperature rise to under two degrees Celsius. Earned CDP scores of A,A- and B in the areas of Supplier Engagement, Climate Change and Water, respectively. Earned a perfect score of 100% on the Human Rights Campaign’s Corporate Equality Index (a national benchmarking tool on corporate policies and practices pertinent to LGBTQ employees) for the fifth consecutive year. Continued commitment to diversity and inclusion. As of December 31, 2018, 44% of Director-level positions and above were held by women. Over 3,200 employees volunteered from 28 countries during our annual Care Deeply Day. Engaged 50,000+ students inhands-on learning to inspire their passion for science since the inception of Biogen’s Community Labs. 2018 Executive Compensation Programs andPay-for-Performance Alignment We believe our executive compensation programs are effectively designed and have worked well to implement apay-for-performance culture that is aligned with the interests of our stockholders. In 2018 our executive compensation programs consisted of base salary, short- and long-term incentives and other benefits. 91% of our CEO’s and 84% of our other NEOs’ 2018 target compensation was performance-based andat-risk.

| * | Reflects annual salary, target bonus and target grant value of the 2018 annual long-term incentive awards. The NEO compensation mix excludes theone-time transition awards thatof RSUs granted to Dr. Ehlers, Ms. Alexander and Dr. McKenzie, as described in further detail below. |

| | | | | | 35 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

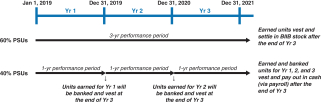

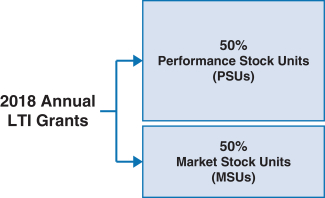

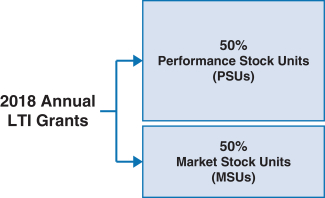

100% of our NEOs’ 2018 annual long-term incentive (LTI) grants were performance-based andat-risk. | | |  | | • 60% earned based on achievement of three-year adjustedNon-GAAP diluted earnings per share (EPS) and pipeline milestone performance goals • 40% earned based on achievement of adjustedNon-GAAP free cash flows and revenues over threeone-year performance periods • PSUs were outstandingintroduced in 2018. For more information on our PSUs, please see “Long-Term Incentives – 2018 PSUs” below. • Earned based on stock price performance over one, two and three year periods |

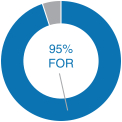

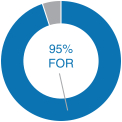

Our 2018 performance-based compensation payouts align with our commitment to strong performance. In 2018 we exceeded the vast majority of the corporate performance goals that we set at the beginning of the year for our incentive compensation plans. As a result, the payouts, as a percentage of target, for our 2018 annual bonus plan and the portions of our PSUs and MSUs that were eligible to be earned based on 2018 performance were above target payout amounts, as described in further detail below. 2018 Advisory Vote on Executive Compensation | | | At our 2018 annual meeting of December 31, 2016stockholders, we continued to receive strong support for eachour executive compensation programs with approximately 95% of the votes cast for approval of our NEOs.annual“say-on-pay” proposal. Our C&MD Committee viewed this as positive support for our executive compensation programs and their alignment with long-term stockholder value creation and determined that the Company’s executive compensation programs have been effective in implementing the Company’s stated compensation philosophy and objectives. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (a) | | | | | Option Awards(1) | | | Stock Awards | | | | | | | | | | | | | | | | | | | | | | | | | Equity Incentive Plan

Awards | | | | | | | | | | | | | | | | Option

Expiration

Date (f) | | | Number

of

Shares

or Units

of Stock

That

Have

Not

Vested(2) (g) | | | Market

Value of

Shares or

Units of

Stock

That

Have Not

Vested(3) (h) | | | Number

of

Unearned

Shares or

Units

That

Have Not

Vested(4)

(i) | | | Market

Value of

Unearned

Shares or

Units That

Have Not

Vested(3)

(j) | | | | Grant

Date (b) | | | Number of Securities

Underlying Unexercised

Options | | | Option

Exercise

Price (e) | | | | | | | | | | Exercisable (c) | | | Unexercisable (d) | | | | | | | | | George A. Scangos | | | 2/12/2013 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 9,191 | | | $ | 2,606,384 | | | | | 2/12/2014 | | | | — | | | | — | | | | — | | | | — | | | | 10,656 | | | $ | 3,021,828 | | | | — | | | | — | | | | | 2/12/2014 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 5,251 | | | $ | 1,489,079 | | | | | 2/23/2015 | | | | — | | | | — | | | | — | | | | — | | | | 8,397 | | | $ | 2,381,221 | | | | — | | | | — | | | | | 2/23/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 8,851 | | | $ | 2,509,967 | | | | | 2/22/2016 | | | | — | | | | — | | | | — | | | | — | | | | 28,890 | | | $ | 8,192,626 | | | | — | | | | — | | | | | | 2/22/2016 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 40,460 | | | $ | 11,473,647 | | | Michel P. Vounatsos | | | 5/2/2016 | | | | — | | | | — | | | | — | | | | — | | | | 6,798 | | | $ | 1,927,777 | | | | — | | | | — | | | | | | 5/2/2016 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 9,520 | | | $ | 2,699,682 | | | Paul J. Clancy | | | 2/12/2013 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,808 | | | $ | 796,293 | | | | | 2/12/2014 | | | | — | | | | — | | | | — | | | | — | | | | 2,483 | | | $ | 704,129 | | | | — | | | | — | | | | | 2/12/2014 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,224 | | | $ | 347,102 | | | | | 2/23/2015 | | | | — | | | | — | | | | — | | | | — | | | | 1,641 | | | $ | 465,355 | | | | — | | | | — | | | | | 2/23/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,731 | | | $ | 490,877 | | | | | 2/22/2016 | | | | — | | | | — | | | | — | | | | — | | | | 7,902 | | | $ | 2,240,849 | | | | — | | | | — | | | | | | 2/22/2016 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11,060 | | | $ | 3,136,395 | | | John G. Cox | | | 2/12/2008 | | | | 2,892 | | | | — | | | $ | 60.56 | | | | 2/11/2018 | | | | — | | | | — | | | | — | | | | — | | | | | 2/24/2009 | | | | 7,588 | | | | — | | | $ | 49.65 | | | | 2/23/2019 | | | | — | | | | — | | | | — | | | | — | | | | | 2/12/2013 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,249 | | | $ | 637,771 | | | | | 2/12/2014 | | | | — | | | | — | | | | — | | | | — | | | | 2,483 | | | $ | 704,129 | | | | — | | | | — | | | | | 2/12/2014 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,224 | | | $ | 347,102 | | | | | 2/23/2015 | | | | — | | | | — | | | | — | | | | — | | | | 2,297 | | | $ | 651,383 | | | | — | | | | — | | | | | 2/23/2015 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,421 | | | $ | 686,547 | | | | | 2/22/2016 | | | | — | | | | — | | | | — | | | | — | | | | 8,466 | | | $ | 2,400,788 | | | | — | | | | — | | | | | 2/22/2016 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11,850 | | | $ | 3,360,423 | | | | | | 4/1/2016 | | | | — | | | | — | | | | — | | | | — | | | | 8,444 | | | $ | 2,394,550 | | | | — | | | | — | | | Michael D. Ehlers | | | 6/1/2016 | | | | — | | | | — | | | | — | | | | — | | | | 8,266 | | | $ | 2,344,072 | | | | — | | | | — | | | | | | 6/1/2016 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,320 | | | $ | 2,075,806 | |

| Notes

Our C&MD Committee is committed to continually reviewing our executive compensation programs on a proactive basis to ensure the ongoing alignment of such programs with the interests of our stockholders. | In 2018 our C&MD Committee reviewed the external landscape, the results from our“say-on-pay” proposal at last year’s annual meeting of stockholders and the Company’s performance against the current compensation programs. Our C&MD Committee was satisfied that our existing compensation programs further ourpay-for-performance philosophy, but made certain enhancements to the Outstanding Equity Awards at 2016 Fiscal Year End Tabledesign of our LTI program in 2018 to strengthen its focus on long-term performance and alignment with our stockholders’ interests. |

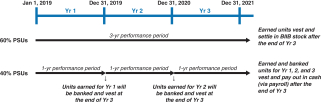

Specifically, under our 2018 LTI program, grants of PSUs replaced grants of cash-settled performance units (CSPUs), which we had granted in previous years. The key changes are as follows: (1) | All stock options were granted with aten-year term. Stock options vest 25% on each of the first four anniversaries of the grant date. It has not been the Company’s practice to cash out stock options having an exercise price greater than the market price (i.e., underwater options). These stock options were subsequently adjusted pursuant to the anti-dilution provisions of such awards in connection with thespin-off of Bioverativ on February 1, 2017. The amounts reported in this column do not reflect such anti-dilution adjustments.PSU awards are subject to three-year cliff vesting as compared to annual ratable vesting over three years (1/3 per year) for CSPU awards; 60% of PSU awards are earned over a three-year performance period based on the achievement of three-year cumulative performance goals for stock-settled PSU awards and 40% of PSU awards are earned over three annual performance periods based on the achievement of three sets of annual performance goals for cash-settled PSU awards as compared to 100% of CSPUs awards earned based upon one annual performance period for CSPU awards; and 60% of the PSU awards will be settled in stock and 40% of the PSU awards will be settled in cash as compared to 100% cash settlement for CSPU awards. | | | | | | 36 | |  | |  |

(2) | CSPUs were granted in 2016, 2015, and 2014. Numbers reflect the number of CSPUs earned and eligible to vest based on our financial performance for each of 2016, 2015, and 2014, but that have not satisfied the service-based vesting requirement as of December 31, 2016. CSPUs that have been earned upon satisfaction of the performance conditions vest ratably over three years from the grant date. The cash payout for these awards will be based on the30-day average closing stock price at vesting. For Mr. Cox and Dr. Ehlers, the amounts in this column also reflect 8,444 RSUs granted to Mr. Cox under his special recognition award on April 1, 2016 and 3,034 RSUs granted to Dr. Ehlers on June 1, 2016 in connection with his hire, each vesting ratably over three years from the grant date. These grants were subsequently adjusted pursuant to the anti-dilution provisions of such awards in connection with thespin-off of Bioverativ on February 1, 2017. The amounts reported in this column do not reflect such anti-dilution adjustments.

| | | | 5 | | Executive Compensation Matters (continued) |

(3) | The market value of awards is based on the closing price of our stock on December 30, 2016 ($283.58), the last business day of 2016, as reported by NASDAQ. |

(4) | MSUs were granted in 2016, 2015, 2014, and 2013. These are performance-based RSUs tied to the growth in our stock price between the dates of grant and vesting. MSUs are eligible to vest ratably over four years for grants made in 2013, and three years for grants made in 2014, 2015, and 2016. The number and value shown in columns (i) and (j), respectively, reflects maximum performance results for MSUs granted in 2013 and 2016 and target performance results for MSUs granted in 2014 and 2015 based on the prior year’s performance in each case. These grants were subsequently adjusted pursuant to the anti-dilution provisions of such awards in connection with thespin-off of Bioverativ on February 1, 2017. The amounts reported in this column do not reflect such anti-dilution adjustments. |

2016 Option Exercises and Stock VestedFor additional information on our PSU awards, please see “Long-Term Incentives – 2018 PSUs” below. Roles and Responsibilities Role of our C&MD Committee Our C&MD Committee, which is composed of four independent directors, oversees and administers our executive compensation programs. In making executive compensation decisions, our C&MD Committee reviews a variety of factors and data, most importantly our performance and individual executives’ performance, and considers the totality of compensation that may be paid. In addition, our C&MD Committee administers our annual bonus plan and our equity plans, reviews business achievements relevant to payouts under our compensation plans, makes recommendations to our Board of Directors with respect to compensation policies and practices as well as the compensation of our CEO and seeks to ensure that total compensation paid to our executive officers is fair, competitive and aligned with stockholder interests. Our C&MD Committee retains the right to hire outside advisors as needed to assist it in reviewing and revising our executive compensation programs. The duties and responsibilities of our C&MD Committee are described on page 20 and can be found in our C&MD Committee’s written charter adopted by our Board of Directors, which can be found on our website,www.biogen.com, under the “Corporate Governance” subsection of the “Investors” section of the website. Role of the Independent Compensation Consultant Our C&MD Committee believes that independent advice is important in developing and overseeing our executive compensation programs. Frederic W. Cook & Co., Inc. (FW Cook) served as our C&MD Committee’s independent compensation consultant until June 2018 and advised our C&MD Committee regarding compensation decisions in 2018. FW Cook did not provide any other services to Biogen. Pearl Meyer & Partners LLC (Pearl Meyer) has served as our C&MD Committee’s independent compensation consultant since June 2018 and has advised our C&MD Committee regarding compensation decisions since that time. Pearl Meyer does not provide any other services to Biogen and engages in other matters as needed and as directed solely by our C&MD Committee. References in this CD&A to our independent compensation consultant refer to FW Cook for the period during which it was engaged and to Pearl Meyer thereafter. Reporting directly to our C&MD Committee, our independent compensation consultant provides guidance on trends in CEO, executive andnon-employee director compensation, the development of specific executive compensation programs and the composition of the Company’s compensation peer group. Additionally, our independent compensation consultant prepares a report on CEO pay that compares each element of compensation to that of CEOs in comparable positions at companies in our peer group. Using this and other similar information, our C&MD Committee recommends, and our Board of Directors approves, the elements and target levels of our CEO’s compensation. During 2018 the Company paid FW Cook and Pearl Meyer $123,275 and $47,666, respectively, in consulting fees directly related to these services. Our C&MD Committee assessed FW Cook’s independence annually and, in accordance with applicable SEC and Nasdaq rules, confirmed in December 2017 that FW Cook’s work did not raise any conflicts of interest and that FW Cook remained independent under applicable rules. Our C&MD Committee assessed Pearl Meyer’s independence in connection with its engagement in June 2018 and, in accordance with applicable SEC and Nasdaq rules, confirmed in December 2018 that Pearl Meyer’s work did not raise any conflicts of interest and that Pearl Meyer remains independent under applicable rules. Role of our CEO Each year our CEO provides an assessment of the performance of each executive officer, other than himself, during the prior year and recommends to our C&MD Committee the compensation to be paid or awarded to each executive. Our CEO’s recommendations are based on numerous factors, including: Company, team and individual performance; potential for future contributions; leadership competencies; external market competitiveness; internal pay comparisons; and other factors deemed relevant. To understand the external market competitiveness of the compensation for our executive officers, our CEO and our C&MD Committee review a report analyzing publicly-available information and surveys prepared by our internal | | | | | | 37 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

compensation group and reviewed by our independent compensation consultant. The report compares the compensation of each executive officer, other than our CEO, to data for comparable positions at companies in our peer group, by compensation element (please see “External Market Competitiveness and Peer Group” below for further details). Our C&MD Committee considers all of the information presented, discusses the recommendations with our CEO and with our independent compensation consultant and applies its judgment to determine the elements of compensation and target compensation levels for each executive officer other than the CEO. Our CEO also provides a self-assessment of his achievements for the prior year. Our C&MD Committee reviews and considers this in analyzing the CEO’s performance, and in recommending for approval by our Board of Directors, the compensation of our CEO. Our CEO does not participate in any deliberations regarding his own compensation. Executive Compensation Philosophy and Objectives Our executive compensation programs are designed to drive the creation of long-term stockholder value by delivering performance-based compensation that is competitive with our peer group in order to attract and retain extraordinary leaders who can perform at high levels and succeed in a demanding business environment. We aim to achieve this by designing programs that are: | • | | Mission Focused and Business Driven.Our executive officers must usecompensation programs support the relentless pursuit of delivering meaningful and innovative therapies to patients by providing our executives with incentives to achieve the near- and long-term objectives of our business. Substantially all of our executive incentive compensation programs are tied directly, and meaningfully, to Company performance. Our objective is to emphasize the importance of achieving short-term goals while building and sustaining a foundation for long-term success. |

| • | | pre-establishedCompetitively Advantageous. trading plansWe benchmark our executive compensation programs against a peer group of biotechnology and pharmaceutical companies that we believe are representative of the companies we primarily compete with for talent, balanced with factors such as business scope and size, including revenues and market capitalization, business focus and geographic scope of operations. Peer group practices are among the many factors we take into account in developing compensation programs that we believe are most effective, and which |

| | enable us to sell sharesrecruit, retain and motivate our leadership team to achieve their best for Biogen and our stockholders. |

| • | | Performance Differentiated. We believe strongly inpay-for-performance and endeavor to significantly differentiate rewards by delivering the highest rewards to our best performers and lesser rewards to those who do not meet our performance expectations. |

| • | | Ownership Aligned. At Biogen, we believe every employee contributes to the success of Biogen stock. Trading plans may only be entered into when the executive is not in possession of materialnon-public information about the Company and, we require | | | | | 48 | |  | |  |

| | | 5 | | Executive Compensation Matters (continued) |

as such, every employee has a waiting period following the establishment of a trading plan before any trades may be executed. Our policy is designed to provide safeguards that will allow our executives an opportunity to realize the value intended by the Company in granting equity-based LTI awards. Our NEOs are also subject to the share ownership guidelines described abovevested interest in the subsection titled “Share Ownership Guidelines.”

The following table shows information regarding vestingCompany’s success. To reinforce this alignment with our stockholders, we strongly encourage stock ownership through our equity-based compensation programs. For members of stock awards for each NEO duringour executive team, including our NEOs, who set and lead the year ended December 31, 2016. Nonefuture strategic direction of our Company, we ensure that a significant portion of their total pay opportunities are equity-based to maintain alignment between the NEOs exercised stock options during the year ended December 31, 2016.

| | | | | | | | | | | | | | | | Stock Awards | | | Name | | Number of Shares

Acquired on

Vesting(1) | | | | | | Value

Realized on

Vesting(2)(3) | | George A. Scangos | | | 57,609 | | | | | | | $ | 14,815,081 | | Paul J. Clancy | | | 15,242 | | | | | | | $ | 3,976,993 | | John G. Cox | | | 15,205 | | | | | | | $ | 3,950,976 | |

Notes to the 2016 Option Exercises and Stock Vested Table

(1) | With the exceptioninterests of Dr. Scangos’ 2014 CSPUs, CSPUs were settled in cash for all of our NEOs. The number of actual shares of our common stock acquired on vesting after shares were withheld to pay the minimum withholding of taxes was as follows: |

| | | | | Net Shares

Acquired(4)

| Dr. Scangos

| | 20,823 | Mr. Clancy

| | 4,613 | Mr. Cox

| | 4,876 |

(2) | The value realized for MSUs and RSUs are calculated by multiplying the closing price of a share of our common stock on the vesting date by the total number of shares that vested on such date. The value realized for CSPUs is calculated using the60-day average closing price of the common stock of the Company through the vesting date for grants made prior to 2014 and the30-day average closing price for grants made in 2014 and later. |

(3) | The value realized upon vesting for Mr. Cox includesnon-qualified deferred CSPUs of $928,065. Terms of thenon-qualified deferred compensation plan are presented in the narrative preceding the 2016Non-Qualified Deferred Compensation Table below. |

(4) | MSUs were settled in shares of our common stock. CSPUs were settled in cash for all of our NEOs, other than Dr. Scangos, in which case a portion of his CSPUs were settled in shares of our common stock. For Dr. Scangos, in 2015, our Compensation Committee exercised its discretion to settle Dr. Scangos’ 2014 CSPUs in shares of our common stock; the net shares acquired by Dr. Scangos reflected in the table above represent 14,792 MSUs and 6,031 CSPUs settled in shares. |

2016Non-Qualified Deferred Compensation

The SSP covers our executive officers and other management employeesour stockholders.

|

| • | | Flexible. We are committed to providing flexible benefits designed to allow our diverse global workforce to have reward opportunities that meet their varied needs so that they are inspired to perform their very best on behalf of patients and stockholders each day. |

External Market Competitiveness and Peer Group We consider market practices and trends when determining executive compensation levels and compensation program designs at Biogen. We do not target a specific market percentile or simply replicate the market practice. Instead, we review external market practices as a reference point to assist us in providing programs designed to attract, retain and inspire extraordinary talent. Our C&MD Committee also uses a peer group to provide context for its executive compensation decision-making. Each year our independent compensation consultant reviews the external market landscape and evaluates the composition of our peer group for appropriateness. Our C&MD Committee reviews the information provided from internal sources as well as the information provided by our independent compensation consultant to select our peer group based on comparable companies that approximate (1) our scope of business, including revenues and market capitalization, (2) our global geographical reach, (3) our research-based business with multiple marketed products and (4) a comparable pool of talent for which we compete. The peer group for determining our 2018 compensation decisions consisted of biotechnology and pharmaceutical | | | | | | 38 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

companies, as we compete with companies in both of these sectors for executive talent. | | | Biotechnology Peers | Alexion Pharmaceuticals, Inc. Amgen Inc. Celgene Corporation Gilead Sciences Inc. Vertex Pharmaceuticals International, Inc. | | | Pharmaceutical Peers | AbbVie Inc. Allergan plc Bristol-Myers Squibb Company Eli Lilly and Company Merck & Co, Inc. Mylan N.V. Bausch Health Companies (f/k/a Valeant Pharmaceuticals Incorporated) |

For each of the companies in our peer group, where available, we analyze the company’s Compensation Discussion and Analysis and other data publicly filed during the prior year to identify the executives at such companies whose positions are comparable to those held by our executive officers. We then compile and analyze the data for each comparable position. Our competitive analysis includes the structure and design of the compensation programs as well as the targeted value of the compensation under these programs. For our executive officers other than our CEO, we may supplement the data from our peer group with published compensation surveys where appropriate. For 2018, consistent with past years, we used theWillisTowersWatson U.S. CDB Pharmaceutical and Health Sciences Executive Compensation Database survey (which we refer to as the Willis Towers Watson survey). We chose the Willis Towers Watson survey because of the number of companies in our peer group that participate in it, the number of positions reported by the survey that continue to be comparable to our executive positions and the high standards under which we understand the survey is conducted (including data collection and analysis methodologies). All of the companies in our peer group are represented in a special cross-section of the Willis Towers Watson survey focused on our peer group, other than Bausch Health Companies (formally known as Valeant Pharmaceuticals Incorporated), which did not participate in the survey. Compensation Elements Our C&MD Committee determines the elements of compensation we provide to our executive officers. The elements of our executive compensation programs and their objectives are as follows: | | | | | | | | | | | | Element | | | | Objective(s) | | | Base Salary | | • | | Provides a fixed level of compensation that is competitive with the external market and reflects each executive’s contributions, experience, responsibilities and potential to contribute to our future success. | | | Annual Bonus Plan | | • | | Aligns short-term compensation with the annual goals of the Company. | | | | • | | Motivates and rewards the achievement of annual Company and individual performance goals that support short- and long-term value creation. | | | Long-term Incentives | | • | | Aligns executives’ interests with the long-term interests of our stockholders by linking the value of awards to increases in our stock price. | | | | | • | | Motivates and rewards the achievement of stock price growth andpre-established corporate performance goals, including those with a longer-term focus. | | | | | • | | Promotes executive retention and stock ownership and focuses executives on enhancing long-term stockholder value. | | | Benefits | | • | | Promotes health and wellness. | | | | | • | | Provides financial protection in the U.S. Employees whose base salaryevent of disability or death. | | | | | • | | Providestax-beneficial ways for executives to save towards their retirement and annual cash incentivesencourages savings through competitive matches to executives’ retirement savings. | | |

Compensation Mix Our C&MD Committee determines the general mix of the elements of our executive compensation programs. It does not target a specific mix of value for the compensation elements within these programs in either the program design or pay decisions. Rather, our C&MD Committee reviews the mix of compensation elements to ensure an appropriate level of performance-based compensation is apportioned to the short-term and even more to the long-term to ensure alignment with our business goals and performance. Additionally, our C&MD Committee believes the greater the leadership responsibilities, the greater the potential impact an individual will have on Biogen’s future strategic direction. Therefore, for our executive officers, including our NEOs, additional emphasis is placed on performance-based compensation, with a particular emphasis on LTI. The 2018 compensation mix for Mr. Vounatsos and our other NEOs was highly performance-based andat-risk; 91% of 2018 compensation was performance-based for Mr. Vounatsos and 84% of 2018 compensation was | | | | | | 39 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

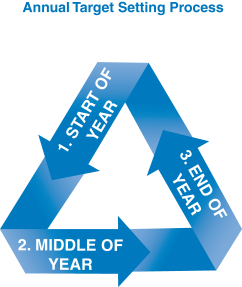

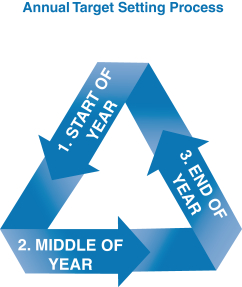

performance-based for our other NEOs, assuming target level achievement of applicable corporate performance goals and with LTI awards measured at target grant date values, and excluding theone-time transition awards of RSUs granted to Dr. Ehlers, Ms. Alexander and Dr. McKenzie, as described in further detail below. Performance Goals and Target Setting Process Early each year, our C&MD Committee reviews and establishes the pay levels of each element of total compensation for our executive officers. Total compensation is comprised of base salary, annual bonus and LTI awards. As part of this process, our C&MD Committee reviews the mix of compensation elements to ensure our performance-based compensation is apportioned appropriately and aligns with our business goals and performance. Our C&MD Committee also ensures that the performance metrics and goals are aligned with the annual business plan approved by our Board of Directors so there is full alignment of executive incentive goals with the goals that have been established for the year. Executive officers are also evaluated based on qualitative factors, such as individual, strategic and leadership achievements. The use of both quantitative and qualitative metrics, as well as the weighting of such metrics, effectively mitigates the impact of a single risk, such as dependence on drug pricing, pipeline performance or market share, on overall compensation. | | | | | | 40 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

A summary of the process our C&MD Committee follows in setting compensation is described below: | | | | |  Target Setting Target Setting

| |

Monitoring & Tracking Monitoring & Tracking

• Our C&MD Committee closely monitors progress against the performance goals throughout the year exceed a specified limit ($265,000and engages in 2016) receive a Company-paid restoration matchdialogue with management on such progress. | |  Results & Awards: Results & Awards:

C&MD Committee Actions

• Reviews and discusses the portionperformance of our executive officers against their respective performance goals. • Reviews and discusses the Company, team and individual performance of each executive officer, other than our CEO, as assessed by our CEO. • Reviews and discusses our CEO’s recommended compensation levels for each executive officer, other than himself, in the context of such executive officer’s contributions to the Company and the other factors described above. • Approves the final compensation for each executive officer other than our CEO, including base salary, annual bonus and payments in respectLTI awards. • Reviews CEO compensation and recommends to our Board of CSPUs that exceeds this limit;Directors for approval the restoration match equals 6%compensation of this excess compensation. The restoration match feature is intended to replace the amount of matching employer contributions that the participant would otherwise have been eligible to receive under our 401(k) plan but for the $265,000 limit imposed by Section 401(a)(17) of the Internal Revenue Code. In addition, eligible employees may make voluntary contributions of up to 80% of theirCEO, including base salary, and 100% of their annual bonus and cash payments in respect of CSPUsLTI awards. | • Our C&MD Committee and our CEO discuss potential goals for the upcoming year that are tied to the SSP,short- and thereby defer income taxes on such amounts until distribution is made from the SSP. The Company does not match participants’ voluntary contributions to the SSP. The SSP provides for immediate vesting of the restoration match consistent with our immediate vesting longer-term strategic goals of the Company match provided under our 401(k) plan.

Notional SSP accounts are maintained for each participant. Accounts include employee and employer contributions and reflect the performance of notional investments selected by the employee or a default investment if the employee does not make a selection. These notional investment options include the mutual funds offered under our 401(k) plan as well as individual goals for our executive officers.

• The annual business plan for the year is approved by our Board of Directors. As part of the approval process, our Board considers many factors relevant to our business, reputation and strategy, including pipeline and business development, pricing and patient access, market expectations and intellectual property risk. • Our C&MD Committee ensures that the performance goals and targets under our compensation plans are aligned with the approved annual business plan. • Payout levels for each performance goal are established by management and approved by our C&MD Committee. • The performance goals are then applied to the compensation opportunities for our executive officers, including NEOs, so that there is full alignment of executive incentive goals with the goals that have been established for the year. • Our C&MD Committee also reviews base salaries, bonus and LTI planning ranges, plan designs, benefits and peer group data. |

| | | | | | 41 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

2018 Base Salary Our Board of Directors reviewed the base salaries of chief executive officers in our peer group and considered Mr. Vounatsos’ compensation mix, capabilities, performance and future expected contributions. Mr. Vounatsos’ base salary was set at $1,300,000, which positioned him below the market median when compared to the chief executive officers of our peer group. Our C&MD Committee undertook a similar review when approving the base salaries for our other NEOs, which positioned them, on average, slightly below the market median compared to persons with comparable jobs within our peer group. The annual base salary of each of our NEOs in 2018, compared to 2017, was as follows: | | | | | | | | | | | | | | Name | | 2018 Salary | | | 2017 Salary | | | % Increase(1) | | | M. Vounatsos | | $ | 1,300,000 | | | $ | 1,100,000 | | | 18.2% | | | J. Capello(2) | | $ | 750,000 | | | $ | 750,000 | | | n/a | | | M. Ehlers | | $ | 834,094 | | | $ | 794,375 | | | 5.0% | | | S. Alexander | | $ | 749,177 | | | $ | 723,842 | | | 3.5% | | | P. McKenzie | | $ | 633,938 | | | $ | 603,750 | | | 5.0% | | |

| (1) | Percentage increase reflects the annual merit increase and, in the case of Mr. Vounatsos, also includes a fixed rate option which earns a ratemarket adjustment. |

| (2) | Mr. Capello was hired in November 2017. The initial determination of returnhis base salary took into account the Company’s peer group data. |

2018 Performance-Based Plans and Goal Setting Our executive compensation programs place a heavy emphasis on performance-based compensation. We maintain a short-term incentive plan, known as our annual bonus plan, as well as an LTI plan. Awards to our NEOs under our annual bonus plan have been made under our 2008 Performance-Based Management Incentive Plan, and awards under our LTI plan are granted under our 2017 Omnibus Equity Plan. Awards made under our annual bonus plan are directly tied to the achievement of our corporate performance goals, which are aligned with the Company’s short- and long-term strategic plans, as well as individual performance goals. Awards made under our LTI plan are directly tied to the performance of the price of our common stock, which aligns our executives’ long-term interests with the interests of our stockholders. A portion of our LTI awards are also tied to the Company’s financial performance, as described below under “Long-Term Incentives – 2018 PSUs.” In setting our annual goals under our short- and long-term incentive plans, in addition to our internal forecasts, we consider analysts’ projections for our performance and the performance of companies in our peer group, as well as broad economic and industry trends. We strive to establish challenging targets that result in payouts at or above target levels only when Company performance warrants it. Our C&MD Committee is responsible for reviewing and approving our annual goals, targets and levels of payout (e.g., threshold, target and maximum) for our executive incentive compensation plans and for reviewing and determining actual performance results at the end of the applicable performance period. In setting and approving the corporate performance goals for our executive officers and for the Company under both the short- and long-term incentive plans, our C&MD Committee also considers the alignment of such goals to our business plan, the degree of difficulty of attainment and the potential for the goals to encourage inappropriate risk-taking. Our C&MD Committee has determined that the structures of our executive compensation programs do not put our patients, investors or the Company at any material risk. Annual Bonus Plan Our annual bonus plan is a cash incentive plan that rewards near-term financial, strategic and operational performance. Our C&MD Committee reviews the annual target bonus opportunities for each executive officer by position each year to ensure such opportunities remain competitive. No significant changes were made in 2018 to the target annual bonus opportunities, as a percentage ofyear-end annual base salary, for any of our NEOs other than Mr. Vounatsos, whose target annual bonus opportunity was market adjusted and increased from 125% of base salary in 2017 to 140% of base salary in 2018. In accordance with our policy, target annual bonus opportunities for all of our other NEOs in 2018 were determined based on their positions as Executive Vice Presidents. | | | | | | 42 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

The target annual bonus opportunity as a percentage ofyear-end annual base salary each of our NEOs in 2018 compared to 2017 was as follows: | | | | | | | | | | Name | | 2018 Target | | | 2017 Target | | M. Vounatsos | | | 140% | | | | 125% | | J. Capello | | | 70% | | | | 70% | | M. Ehlers | | | 70% | | | | 70% | | S. Alexander | | | 70% | | | | 70% | | P. McKenzie | | | 70% | | | | 70% | |

2018 Annual Bonus Plan Design Awards for our NEOs under our 2018 annual bonus plan were based on the achievement of Company performance goals and individual performance goals. At the beginning of 2018, our C&MD Committee set multiple Company performance goals for our 2018 annual bonus plan and provided for a payout multiplier, which we refer to as the Company Multiplier, ranging from 0% to 150%, for each Company goal based on the determination of the level of achievement of each goal and application of the weighting assigned to each goal, which determined the Company Multiplier applied to the bonus calculation. The Company Multiplier ranged from 0% to 150% as follows: | | | | | | | | | | | | | | Performance Multipliers | | Below Threshold | | Threshold | | Target | | Max | Company | | 0% | | 50% | | 100% | | 150% |

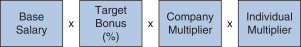

In addition, our 2018 annual bonus plan payouts were also based on an assessment of each NEO’s individual performance, taking into account his or her achievement of individual performance goals. Evaluating individual performance allows our C&MD Committee the discretion to increase or decrease each NEO’s bonus amount based on the NEO’s performance by applying an individual performance multiplier, ranging from 0% to 150%, which we refer to as the Individual Multiplier. We determined the individual annual bonus payments for 2018 using the following calculation:

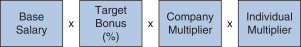

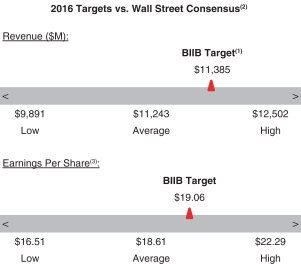

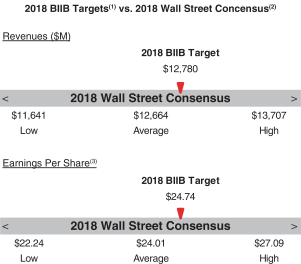

Our 2018 annual bonus plan provided that if the Company Multiplier was less than 50%, there would be no payout, regardless of individual performance, further strengthening ourpay-for-performance philosophy. Further, because the Individual Multiplier and the Company Multiplier each have a maximum of 150%, the combined multiplier result for each NEO could not exceed 225%. 2018 Company Performance Goals and Results Company performance goals were established at the start of 2018 with assigned weightings that reflected the Company’s focus on attaining both financial and strategic goals (pipeline performance, MS leadership, continued SMA launch excellence and enhancing our strategic alliances). The goals and weightings we selected reflect the importance of linking reward opportunities to both near-term results and our progress in achieving longer-term goals. The strategic goals we selected in 2018 were designed to measure the achievement of our annual strategic priorities relating to our commercial opportunities and pipeline progress. Our financial performance goals were based on the Company’s annual operating plan and long-range plan approved by our Board of Directors and with reference to analyst consensus for Biogen revenues andNon-GAAP diluted EPS based on the most current analyst reports at the time we set our targets. The following table presents our financial targets relative to analysts’ consensus for 2018:

(1) Please see “2018 Annual Bonus Plan Company Performance Targets and Results Table” below for more details. (2) Wall Street figures reflect estimates made in January 2018 for the Biogen fiscal year ending December 31, 2018. (3) ReflectsNon-GAAP diluted EPS. | | | | | | 43 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

2018 Annual Bonus Plan Company Performance Targets and Results Table Set forth below is a summary of the Company performance goals and weightings that our C&MD Committee established for our 2018 annual bonus plan and the degree to which we attained these Company performance goals. As described below, the Company Multiplier for the 2018 Annual Bonus Plan was 131%, reflecting the strong performance relative to ourpre-established goals. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance Range | | | | | | | | | | | | | | | Company Goals | | Weight | | | Threshold | | | Target | | | Max | | | Results | | | Company Multiplier | | FINANCIAL PERFORMANCE | | | | | | | | | | | | | | | | | | | | | | | | | Revenues | | | 20 | % | | $ | 12,310M | | | $ | 12,780M | | | $ | 13,250M | | | $ | 13,363M | (1) | | | 150.0 | % | Non-GAAP diluted EPS | | | 20 | % | | $ | 23.47 | | | $ | 24.74 | | | $ | 26.01 | | | $ | 26.89 | (1) | | | 150.0 | % | MARKET PERFORMANCE | | | | | | | | | | | | | | | | | Achieve Global MS Market Share | | | 15 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Below

Goal(2) |

| | | 91.8 | % | MS Leader in Customer Trust and Value Survey | | | 10 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Above

Goal(2) |

| | | 125.0 | % | Achieve Global SMA Market Share | | | 10 | % | |

| Specific market goals

are not disclosed for competitive reasons |

| |

| Above

Goal(2) |

| | | 134.9 | % | PIPELINE DEVELOPMENT | | | | | | | | | | | | | | | | | Build and Advance Total Pipeline | | | 10 | % | |

| Specific pipeline goals

are not disclosed for competitive reasons |

| |

| Above

Goal(3) |

| | | 110.0 | % | Achieve Aducanumab Phase 3 Enrollment | | | 5 | % | |

| Specific enrollment goals

are not disclosed for competitive reasons |

| |

| Above

Goal(4) |

| | | 105.0 | % | COLLABORATION | | | | | | | | | | | | | | | | | Improve and Expand Key Strategic Alliances | | | 10 | % | |

| Specific strategic

alliance goals are not

disclosed for competitive reasons |

| |

| Above

Goal(5) |

| | | 150.0 | % | Company Multiplier | | | | 131.0 | %* |

| * | Numbers may not recalculate due to rounding. |

Notes to 2018 Annual Bonus Plan Company Performance Targets and Results Table | (1) | These financial measures were based on our publicly reported revenues of $13,453 million and our publicly announcedNon-GAAP diluted EPS of $26.20, as adjusted as follows: for purposes of our 2018 annual bonus plan, revenues andNon-GAAP diluted EPS were adjusted to neutralize the effects of foreign exchange rate fluctuations.Non-GAAP diluted EPS was further adjusted to add back $1.21 to reflect the impact of additional research and development expense recognized in 2018 resulting from the 2018 Ionis Agreement and $0.07 to neutralize the unfavorable impact of the worldwide withdrawal of ZINBRYTA, partially offset by the Company’s retirement committee. For contributionssubtraction of $0.59 related to higher than originally contemplated stock repurchases in 2018, as these charges were not originally contemplated at the time the Company performance goals were determined. |

| (2) | Achievement of market goals for MS was below goal and achievement of MS leader and market goals for SMA were above goals. Specific details are not disclosed for competitive reasons. |

| (3) | The Company continued to expand andre-shape its pipeline ofpre-clinical and clinical stage programs through the advancement of internal programs, external business development activities and exceeding expectations with respect to the SSP fixed rate optionlevel of confidence in 2016, this rateand momentum of return is set at 5.50%. Contributions to the fixedits clinical stage portfolio. Specific details are not disclosed for competitive reasons. |

| (4) | Aducanumab Phase 3 clinical trial patient enrollment was above goal. Specific details are not disclosed for competitive reasons. |

| (5) | Key strategic alliance and acquisition activities were above goal. Specific details are not disclosed for competitive reasons. |

| | | | | | 44 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

2018 Individual Performance Goals and Results The Individual Multiplier reflects each named executive officer’s overall individual performance rating as part of our performance assessment process. Unlike our formulaic calculation of corporate performance against Company performance goals in determining the Company Multiplier, each named executive officer’s Individual Multiplier is based on a subjective evaluation of his or her overall performance and consideration of the achievement of individual goals established at the beginning of the year. Goals may be both quantitative and qualitative. For 2018 Mr. Vounatsos recommended to our C&MD Committee an Individual Multiplier for each named executive officer other than himself based on his assessment of their individual contributions for the full year. Our C&MD Committee considered all of the information presented, discussed our CEO’s recommendations with him and its independent compensation consultant and applied its judgment to determine the Individual Multiplier for each named executive officer. Our Board of Directors determined Mr. Vounatsos’ Individual Multiplier based on its assessment of his performance. In its evaluation, our C&MD Committee assigned Individual Multipliers to our named executive officers of between 115% and 140% based on the following accomplishments during 2018: Michel Vounatsos Contributed to the achievement of record revenues of $13,453 million and $26.20Non-GAAP diluted EPS for the year ended December 31, 2018, versus targets of $12,780 million and $24.74, respectively. Excelled in leading the Company in achieving its financial and business development goals. Added substantial value to our business development activities and the diversification of our pipeline. Contributed significantly to the demonstrated resilience in our MS business, the continued successful launch of SPINRAZA worldwide and the significant progress made in our biosimilars business. Drove our ongoing improvements in our core processes to improve operating efficiencies, capital allocation and asset optimization while adhering to our core values. Jeffrey D. Capello Contributed to the achievement of record revenues of $13,453 million and $26.20Non-GAAP diluted EPS for the year ended December 31, 2018, versus targets of $12,780 million and $24.74, respectively. Significantly improved our Finance organization structure and key processes, including improved financial forecasting and planning and tax and treasury planning. Added substantial value to our business development activities and the diversification of our pipeline. Contributed to the return of approximately $4.4 billion to stockholders in 2018 through share repurchases under our 2018 Share Repurchase Program and 2016 Share Repurchase Program. Contributed to excellent interactions with investors leading to transparent and trusted dialogue. Contributed to improvements in our core processes to improve operating efficiencies, capital allocation and asset optimization while adhering to our core values. Supported our Board of Directors, the CEO and executive team. Michael Ehlers Exceeded portfolio value and clinical development goals. Significantly progressed and developed our pipeline. Significantly improved our Research and Development organization structure, key processes and productivity. Added new capabilities and talent to our Research and Development organization. Excelled in leadership of our Research and Development organization. Added substantial value to our business development activities. Contributed to excellent interactions with investors leading to transparent and trusted dialogue. Susan H. Alexander Supported our Board of Directors, the CEO and executive team and SEC disclosure requirements. Strengthened the intellectual property rights of our key assets, including our intellectual property related to TECFIDERA. Excelled in leadership of our Legal and Compliance teams. Contributed significantly on strategy and the resolution of general business issues affecting the Company, including our expansion into Asia Pacific and Latin America. Supported the effective transition of the corporate services functions, including IT, to Mr. Capello. Paul F. McKenzie Excelled in management of our large and complex manufacturing organization. Maintained excellence in manufacturing plant quality. | | | | | | 45 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

Excelled in leadership of our Pharmaceutical Operations and Technology organization. Contributed significantly on strategy and the resolution of general business issues affecting the Company. Contributed to the significant progress in our biosimilars business. Exhibited outstanding leadership, fostering a culture of continuous improvement and cost-consciousness. In addition, our C&MD Committee reviews on a qualitative basis each named executive officer’s other contributions to the Company and our business, leadership competencies and relative performance among our named executive officers. 2018 Annual Bonus Plan Awards Our C&MD Committee determined that the final bonus awards under our 2018 annual bonus plan were as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Year-end Salary (A) x | | | Target Bonus% (B) x | | | Company Multiplier (C) x | | | Individual Multiplier (D) = | | | Bonus Award (E) | | | | | | | | | | | | | | M. Vounatsos | | $ | 1,300,000 | | | | 140 | % | | | 131 | % | | | 140 | % | | $ | 3,337,880 | | | | | | | | | | | | | | J. Capello | | $ | 750,000 | | | | 70 | % | | | 131 | % | | | 115 | % | | $ | 790,913 | | | | | | | | | | | | | | M. Ehlers | | $ | 834,094 | | | | 70 | % | | | 131 | % | | | 120 | % | | $ | 917,837 | | | | | | | | | | | | | | S. Alexander | | $ | 749,177 | | | | 70 | % | | | 131 | % | | | 125 | % | | $ | 858,744 | | | | | | | | | | | | | | P. McKenzie | | $ | 633,938 | | | | 70 | % | | | 131 | % | | | 135 | % | | $ | 784,784 | | | | | | | |

Long-Term Incentives | | | | | | | | | | | Terms | | Performance Stock Units (PSUs) | | Market Share Units (MSUs) | | | | Proportion of Annual Target Value | | 50% | | 50% | | | | | Settlement | | 60% stock settled | | 40% cash settled | | 100% stock settled | | | | | | Performance Period(s) | | 3 years (2018-2020) | | 1 year (each of 2018, 2019, 2020) | | 1 year, 2 years, 3 years (from grant date) | | | | | Metrics and Weighting | | AdjustedNon-GAAP diluted EPS: 30% Pipeline Milestone Performance: 30% | | Adjusted Free Cash Flow: 28% Revenues: 12% | | Stock Price: 100% | | | | | Threshold / Maximum Payout (% of Target Award) | | 50% / 200% | | 50% / 200% | | 50% / 200% | | | | | | Vesting | | 3-year Cliff Vesting | | 3-year Cliff Vesting | | Annual Ratable Vesting over 3 years (1/3 per year) | | | | |

All annual LTI awards granted to our executives are performance-based and designed to reward long-term Company performance. Our executive annual LTI program for 2018 consisted of PSUs and MSUs, with the annual LTI total target grant value of awards being split evenly between PSUs and MSUs. The PSUs we awarded to executive officers are performance-based RSUs that are settled, as applicable, in cash and shares of our common stock. The MSUs we awarded to executive officers are performance-based RSUs that are settled in shares of our common stock. The performance conditions applicable to these PSUs and MSUs are described in further detail below. Our annual LTI target grant values are differentiated based on an executive’s individual performance, potential future contributions and market competitiveness, as well as other factors. In determining the annual LTI target grant value, our C&MD Committee reviews LTI awards of our peer group and also reviews the total compensation of our executive officers against our peer group. In general, we have a heavier weighting in executive compensation mix towards LTI awards. On average, annual LTI target grant values for our NEOs position their total compensation at or around the median values of our peer group in cases where there are comparable positions at the peer companies. | | | | | | 46 | |  | |  |

| | | | 5 | | Executive Compensation Matters (continued) |

We have an established annual LTI grant practice where LTI grants are made following the completion of our internal performance reviews of our executive officers as well as our external market review of equity practices of our peer group, including the data from the Willis Towers Watson survey described above. Since 2004 we have made our annual LTI grants in February of each year following our annual earnings release. We generally grant time-based RSUs in lieu of PSUs at the time an executive is hired if employment commences after June 30th. These grants are generally granted on the first trading day of the month following the date of hire. From time to time, we also grant time-based RSUs to recognize extraordinary contributions to the Company or for transition or retention purposes. In 2018 the annual LTI target grant values for our NEOs were as follows: | | | | | | | | | Name | | Annual LTI

Target Grant Value | | | | | | | | | M. Vounatsos | | $11,500,000 | | | | | | | | | J. Capello(1) | | n/a | | | | | | | | | M. Ehlers(2) | | $ 3,750,000 | | | | | | | | | S. Alexander(2) | | $ 3,200,000 | | | | | | | | | P. McKenzie(2) | | $ 3,000,000 | | | | | |

Notes to the 2018 Annual LTI Awards Table | (1) | In lieu of a 2018 annual LTI award, Mr. Capello received a new hire grant in January 2018, which consisted of PSUs and MSUs with an aggregate grant date target value of $3.0 million. The initial determination of these awards took into account the Company’s peer group data. |

| (2) | In addition to the annual LTI award, Dr. Ehlers, Ms. Alexander and Dr. McKenzie each received aone-time transition award of RSUs, as described in further detail below. |

The actual value that will be realized from PSU awards depends on the degree of achievement of performance goals, with 60% of the PSUs (based on the grant date target value) settled in shares of our common stock based upon achievement of cumulative three-year financial and pipeline metrics and the remaining 40% of the PSUs settled in cash based upon the achievement of two annual financial metrics that are determined at the beginning of each relevant year. The actual value that will be realized from MSU awards depends on our30-day average common stock price growth between the grant date and each of the dates such awards vest. Our common stock price is influenced by the Company’s performance as well as external market factors. 2018 PSUs PSUs comprised 50% of our executives’ target LTI for 2018. PSUs are performance-based RSUs that have three-year cliff vesting in furtherance of the Company’s long-termpay-for-performance philosophy and to encourage employee retention. PSUs align executive compensation to Company goals through performance against a combination of financial and pipeline milestone performance metrics. The actual value (if any) of PSUs will not be realized by the NEOs until the three-year period ends and then only if the applicable performance goals are achieved. For our 2018 PSU awards, 60% of the PSUs (based on the grant date target value) will be settled in shares of our common stock based on achievement of financial and pipeline performance goals over a three-year performance period (the 2018 Stock-Settled PSUs). The remaining 40% of the PSUs will be settled in cash based on the achievement of three sets ofone-year financial goals (the 2018 Cash-Settled PSUs) and continued employment through the vesting date. Our 2018 PSU awards are scheduled to vest in February 2021. For our 2018 PSU awards, the number of PSUs earned at the end of the three-year performance period will be determined as follows:

In designing our 2018 PSU LTI program, our C&MD Committee acknowledged the need to balance driving long-term performance and investing for the future with achieving key milestones along the way. Cash payments are primarily aligned with and reward more recent performance, while equity awards encourage our executives to continue to deliver results over a longer period of time and also serve as a retention tool. Accordingly, our C&MD Committee determined that moving compensation for our executive officers further away from cash and towards equity awards with longer-term goals would further align their interests with those of Biogen’s stockholders in creating long-term stockholder value.

| | | | 5 | | Executive Compensation Matters (continued) |

2018 PSU Awards Table Set forth below is a summary of the performance metrics and weightings that our C&MD Committee established for our 2018 PSU awards and the degree to which we achieved the performance goals for the 2018 tranche of the 2018 Cash-Settled PSUs. Based on the results outlined in the table below, the multiplier for the 2018 tranche of the 2018 Cash-Settled PSUs was 192%. | | | | | | | | | | | | | | | | | | | | | | | | Percentage of

PSU Award | | Percentage of PSU Target

Value / Total

LTI Target

Value | | Performance Metrics | | Performance

Metrics

Weight | | | Performance

Period | | | Target Performance | | Actual Performance | Stock- Settled: 60% | | 60% / 30% | | Adjusted Non-GAAP diluted EPS Pipeline Milestone Performance | |

| 30%

30% |

| |

| 2018-2020

2018-2020 |

| | Specific goals are not disclosed for competitive reasons | Cash- Settled: 40% | | 40% / 20% | | Adjusted Free Cash Flows Revenues | | | 28% 12% | | |

| 2018

2019 2020 2018 2019 2020 |

| | $ 2.9B Target set at beginning of 2019 Target set at beginning of 2020 $ 12.8B Target set at beginning of 2019 Target set at beginning of 2020 | | $ 4.0B(1)

TBDTBD $ 13.4B(2)

TBD TBD |

Notes to the 2018 PSU Awards Table | (1) | This financial measure was based on ourNon-GAAP free cash flows, as adjusted to add back $256 million to reflect the cash impact of additional research and development expense recognized in 2018 resulting from the 2018 Ionis Agreement, $16 million to neutralize the unfavorable cash impact of the worldwide withdrawal of ZINBRYTA and $33 million related to higher than originally contemplated stock repurchases in 2018, partially offset by the subtraction of $235 million to reflect tax payments made in connection with tax reform, as these charges were not originally contemplated at the time these performance goals were determined. |

| (2) | This financial measure was based on our publicly reported revenues of $13.5 billion, as adjusted to neutralize the effects of foreign exchange rate fluctuations. |